The Taxpayer Identification Number TIN is a one of a kind number allotted and issued to distinguish a man individual or Company as an appropriately enrolled citizen in Nigeria. The Federal Inland Revenue Service FIRS has further extended the closing date of its waiver of penalty and interest window on tax debts owed by individuals and businesses from June 30 2020 to August 31st 2020.

A Detailed Guide To Get Your Tax Identification Number In 5 Days Smart Entrepreneur Blog

Upon incorporation of a company in Nigeria the next mandatory step towards doing business in Nigeria is tax identification number registration.

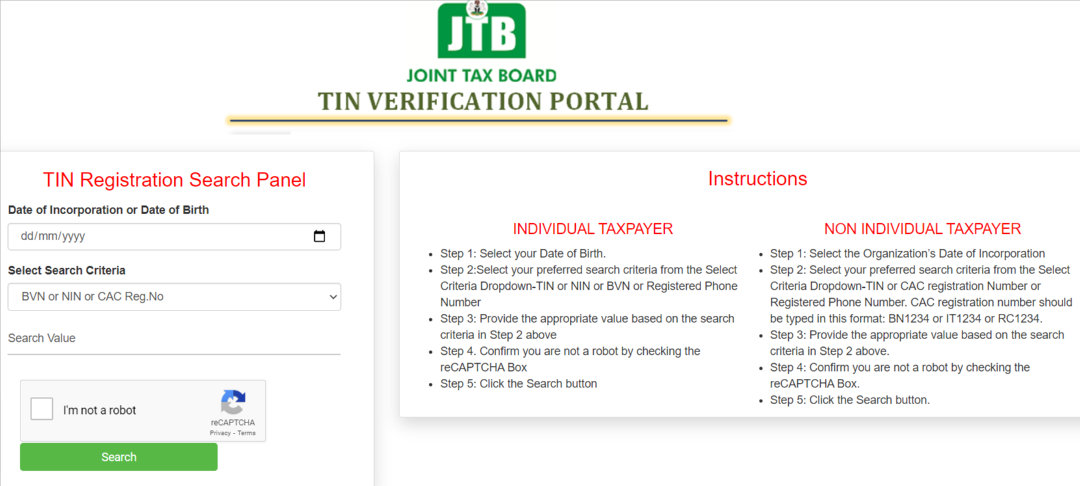

Nigeria tin online registration. Click Register if you are first time user Click Login if you have an account to Login. Registered businesses can check or verify their TIN via httpappsfirsgovngtinverification. TIN as fondly called is generated by the Tax Authority for proper identification order and ensuring that more people are brought to the tax net.

Below is how to register for TIN Tax Identification Number online in Nigeria. Select CAC Registration number in the search criteria dropdown list then enter the Number Registered with Corporate Affairs Commision preceeded by the corresponding alphabets eg RC12345 for Corporate entities and BN12345 for Enterprises or as the case may be in the search value field. TIN is free For registered businesses that have not obtained or have forgotten their TIN click HERE.

Usually the number is issued by the Tax Authority through Joint Tax Board portal online or via an application. Enter your TINregisted phone number. Registration for tax purposes is a legal obligation of every person who is required to pay tax in Nigeria.

Individuals are automatically assigned a TIN based on their BVN or National Identity Number NIN. After you must have registered and commenced your small business you must have an understanding of tax issues in Nigeria. Next access tin registration system.

The procedure for how to obtain TIN in Nigeria has been simplified over the years by the FIRS. B Pay the Annual Registration Fee P50000 at the Authorized Agent Banks of the RDO. Pick the Registered Phone Number line.

CAC usually issues TIN to all registered companies enterprises and not-for-profit organizations. Click the search bar and youll get a confirmation message. INDIVIDUAL ONLINE TIN APPLICATION.

On that page select CAC Registration number under Select Search Criteria on the next column Search Value type in your registration number eg. You need to know the various documents you would need to apply for TIN as a company already incorporated. This is to inform our esteemed customers that as part of the Ease of Doing Business Initiatives Certificates of Incorporation of companies registered under Part A of CAMA will henceforth bear the Tax Identification Numbers TIN issued by the Federal Inland Revenue Service FIRS to such companies.

It really is not simply the quantity of data that makes arranging it difficult but in addition the difficulty of determining individuals. You can use this guide to apply and validate your Tax Identification Number TIN in Nigeria. To get a TIN as an individual you need to have a NIN or BVN.

The Joint Tax Board JTB has launched a new national registration system that would enable Nigerians to obtain their taxpayer identification number TIN online. Visit the address and type in the RC Number BN Number. If you happened to go to a particular office of the Federal Inland Revenue Service the agency charged with TIN registration you could face a lot of frustrations.

Search using CAC Registration Number. If you are also the tech savvy business person you can do all your TIN registration online by checking the FIRS service platform. Some companies like to use fully-verified service to help verify and protect your identity.

Check the status of taxpayer identification number TIN. Kindly note that a non-individual is regarded to be a Limited Liability Companies Incorporated Trustees Enterprises Cooperative Society MDAs Trade Association and so on. Non Individuals such as Limited Liability Companies Incorporated Trustees Enterprises Cooperative Society MDAs Trade Association etc can register for their TIN online by clicking here.

In order to obtain your TIN number in Nigeria you need to follow a process laid down by the Joint Tax Board JTB in Nigeria. This TIN number is what identifies individuals corporate organizations as registered tax payers in the country. You can check online to see if.

The Joint Tax Board has an improved electronic system for obtaining you TIN number and this is. The body regulating tax administrations in Nigeria is the Joint Tax Board JTB while the regulatory agency in charge of issuing Tax Identification. Please note that there is no space between the letters and digits and you must add the RC or BN or else there will be error in the returned query.

How to applyregister for Tax Identification Number in Nigeria tinjtbgovng. Enlistment for assess objects is a lawful commitment of each individual who is required to pay charge in Nigeria. Check out the TIN Verification Portal.

In order to get your TIN as an individual the Joint Tax Board website has stipulated that you must provide your Bank Verification Number BVN as a criterion. How to Apply for Tax Identification Number TIN online. All registration statements have been made by the Joint tax board on registering for the TIN.

Input the correct captcha image text and click on the search button. How To Apply For Tax Identification Number TIN Online in 2021. FIRS extends tax debt payments to August 31st.

It is to be utilized by that citizen alone. TIN Number The IRS need to method a massive quantity of data involving numerous millions of US citizens. Tax Identification Number TIN is a unique number given to an individual a registered business or incorporated companies for the purpose of tax payment.

Registration for TIN Tax Identification Number in Nigeria is now easy. As a Nigerian citizen who owns a business or working in a private organization or even in the civil service you are expected to have your Tax Identification Number TIN. And type in your RC NumberBN Number to ascertain your TINYour corresponding business name August 10 2018 Read more.

You might be redirected to visit the. The TIN is also displayed on incorporation documents. At Tax Office you will obtain the VAT Registration Form 001 and.

Before now people usually complained about the stress they go through before they can register for TIN Tax Identification Number in Nigeria. A Accomplish BIR Form 1901and submit the same together with the required attachments to the Revenue District Office having jurisdiction over the registered address of the trusts. The first thing is for you to visit the tax office and apply for Tax Identification Number TIN and VAT registration.

TIN Request Non-Individual Organization Type.

How To Get Firs Tax Identification Number Or Use The Tin Verification Portal

Tidak ada komentar